Key Take Away

Flashpoint Payment and Credit Card Fraud Mitigation

We are excited to announce the launch of Flashpoint Payment and Credit Card Fraud Mitigation, providing fraud teams an end-to-end solution with actionable dashboards and analytics to rapidly and comprehensively mitigate card fraud.

Introducing Flashpoint Payment and Credit Card Fraud Mitigation

We are excited to announce the launch of Flashpoint Payment and Credit Card Fraud Mitigation, providing fraud teams an end-to-end solution with actionable dashboards and analytics to rapidly and comprehensively mitigate card fraud.

Combat Escalating Card Fraud Threats

Fraud actors continue to raise the bar of their operations both in the scale and sophistication of their techniques, and these activities are leading to significant exposure and losses for financial institutions, card issuers, and other enterprises. On average, financial institutions suffer an estimated $300 loss, per stolen credit card. These losses add up quickly when you account for the near 45% hike in reported card fraud losses comparing 2019 to 2020 (271,927 vs. 393,207), according to the U.S. Federal Trade Commission (FTC).

Now with Flashpoint’s extended card fraud threat intelligence and unified dashboards, financial institutions and all other card issuers can streamline their card fraud detection and prevention efforts with one end-to-end solution from Flashpoint.

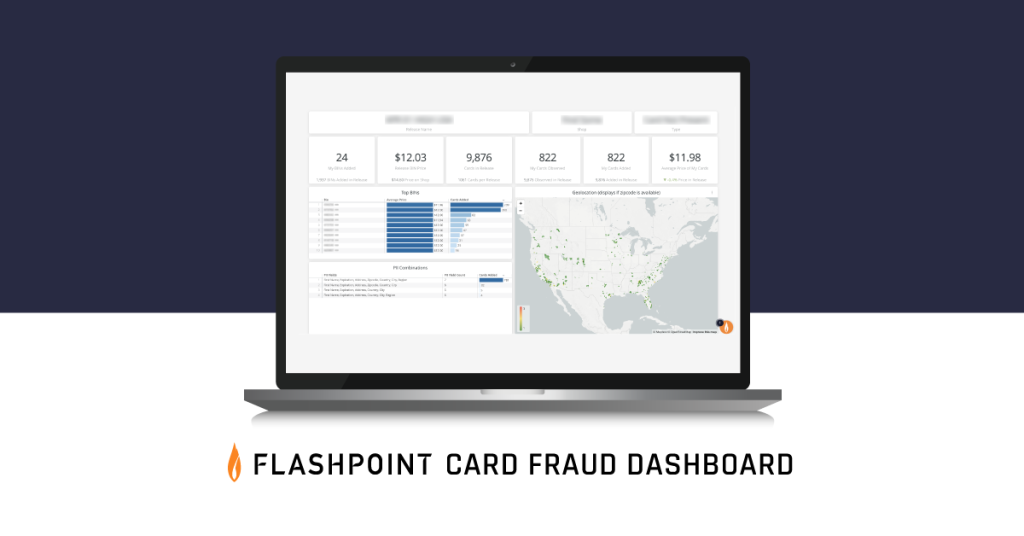

Streamline Team Operations with Flashpoint Card Fraud Dashboards and Analytics

Prove ROI Immediately

From the outset, Flashpoint provides organizations with valuable financial insight into their return on investment (ROI). Prominently displayed in the main dashboard, ROI metrics calculate and track organizations’ potential card fraud loss exposure, measuring the per-card loss estimates and count totals of all vulnerable cards potentially available to cybercriminal buyers on illicit online communities.

Eliminate Operational Drag and Close Cards Faster

Fraud teams gain access to all of Flashpoint’s compromised card datasets and begin receiving new streams of information covering discovered breaches and associated cybercriminal activity throughout illicit communities, forums, and marketplaces online. Fraud analysts can dig deeper through the data viewing records prioritized on relevance and exposure, or customize their own searches using pre-indexed filters and attributes.

This functionality allows teams to analyze and triage cards rapidly from within the broader Flashpoint converged intelligence platform, determining the appropriate response and recovery decision paths in fractions of the time it used to take.

Detect, Analyze, and Mitigate Card Fraud End-to-End with Flashpoint

Minimize Your Card Fraud Exposure with the Only Comprehensive Solution on the Market

The Flashpoint Payment and Credit Card Fraud Mitigation solution is packed with even more capabilities and benefits, including:

- Comprehensive collections that enable granular analysis and benchmarking. Fraud analysts have intricate data fields and card attributes at their disposal. Or they can designate full collections of cards to compare their pooled exposure against an entire swath of dumped or breached cards.

- Centralized BIN management and flexible tagging that minimize repetitive tasks. It’s easier than ever for users to manage and upload bank identification numbers (BINs). Flashpoint enables BIN tagging and a host of features to organize, group, and sort BINs based on specific brands, cards, and customer segments.

- Continual, active monitoring that ensures rapid triage. Threat actors often release data over extended periods of time, which means that fraud teams must stay vigilant as new releases potentially throw their fraud exposure out of whack. Customers gain visibility into all of Flashpoint’s ongoing and active cybercriminal intelligence, which often leads to the identification of early, pre-release signals and accurate forecasts of new, upcoming card dumps and breaches.

- Full-suite exporting further extends use-cases and reporting. Fraud teams can easily share critical data, reports, raw data in one-off or bulk delivery formats, including PDFs, CSVs, scheduled emails, and your own designed webhooks.

See the New Flashpoint Card Fraud Solution for Yourself

Sign up for a demo! Discover firsthand the new Flashpoint Payment and Credit Card Fraud Mitigation solution and see how Flashpoint can supercharge your fraud team with the tools they need to combat card fraud today.